Q&A Guide: Understanding Ratio Tech’s BNPL and Revenue-Based Financing for B2B Companies

by Myrtle Von

What exactly does RBF mean for a SaaS company?

Revenue-Based Financing (RBF) for a SaaS company means leveraging a portion of monthly or annual recurring revenues to secure funding, which is repaid based on future income. This financing method aligns well with the SaaS model's revenue streams, providing flexibility and maintaining cash flow without diluting equity.

How does revenue-based financing differ from traditional loans?

Unlike traditional loans, which typically require fixed monthly payments regardless of a business’s financial performance, RBF payments are tied to the company’s revenues. This means payments fluctuate with the company's income, making it a less burdensome financial commitment during slower business periods.

Can revenue-based financing improve my company's cash flow?

Yes, RBF can improve cash flow by providing capital that does not require the rigid repayment structure of traditional loans. This flexibility helps maintain liquidity, especially crucial for businesses in growth phases or experiencing variable income.

What are the typical terms of an RBF agreement?

Typical RBF terms involve a percentage of ongoing revenue paid to the financier until a predetermined amount (usually a multiple of the borrowed sum) is repaid. The specific percentage and total repayment amount can vary based on the agreement tailored to the company's revenue projections and financial needs.

Is revenue-based financing suitable for all types of businesses?

RBF is best suited for businesses with predictable and recurring revenue streams. This includes SaaS companies, subscription-based services, and businesses with consistent sales cycles. It may not be as suitable for companies with highly variable or unpredictable revenue patterns.

How do I know if my business is a good candidate for revenue-based financing?

Businesses with strong gross margins, consistent revenue growth, and a scalable product or service model are ideal candidates for RBF. If your business has a clear path to revenue growth and requires flexibility in funding without giving up equity, RBF could be a suitable option.

How can Ratio Tech’s BNPL solutions benefit my business?

Ratio Tech’s BNPL solutions allow businesses to offer their customers flexible payment terms, thus potentially increasing sales and improving customer satisfaction. For B2B companies, this can mean quicker procurement processes and less friction in closing large deals, especially where upfront costs might otherwise be a barrier.

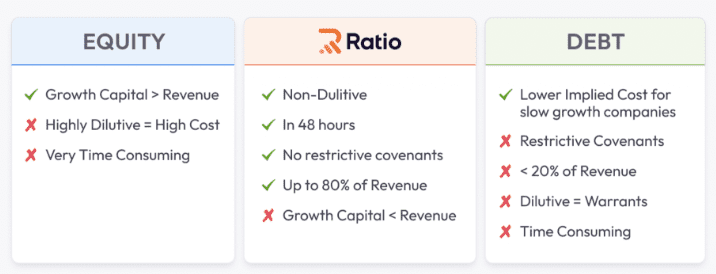

What makes revenue-based financing a good choice for B2B companies?

For B2B companies, especially those in tech or service industries, RBF allows for growth financing that aligns with business income flows, reducing the pressure of fixed repayments and aiding in smoother financial operations.

How does Ratio Tech tailor its services to different industries?

Ratio Tech’s approach involves understanding the specific needs and revenue models of different industries to provide tailored financing solutions. This bespoke approach ensures that the financing support provided aligns well with the business operations and growth strategies of its clients.

Can adopting BNPL solutions impact my business credit?

Adopting BNPL solutions does not directly impact a company’s credit score, as these solutions are typically structured as business transactions rather than credit facilities. However, the financial stability brought by effective BNPL offerings can indirectly benefit a business’s creditworthiness by improving cash flow and revenue consistency.

What are the key differences between traditional loans and RBF?

The primary difference lies in the repayment terms. Traditional loans require fixed repayments, while RBF adapts to your company's financial performance, offering more flexibility during lower revenue periods and aligning repayment terms with your business cycle.

How quickly can businesses access funds with Ratio Tech’s financing options?

Ratio Tech’s financing solutions, including BNPL and RBF, are designed to provide quick access to funds, often with shorter processing times and less stringent approval requirements than traditional banks. This speed can be crucial for businesses needing to capitalize on immediate growth opportunities.

By addressing these queries, potential clients and industry partners can better understand how Ratio Tech’s innovative financing solutions could be leveraged to support their growth and operational needs effectively.

What exactly does RBF mean for a SaaS company? Revenue-Based Financing (RBF) for a SaaS company means leveraging a portion of monthly or annual recurring revenues to secure funding, which is repaid based on future income. This financing method aligns well with the SaaS model's revenue streams, providing flexibility and maintaining cash flow without diluting…

Recent Posts

- Why You Should Consider Adding a Fireplace to Your Lexington Home Remodel

- How Chicago’s Best Cleaning Services Help You Prepare for Special Occasions

- How Local Travel Agents Can Secure the Best Deals for Your Destination

- How to Protect Your Hair During Summer with Help from the Best Hair Salons in Franklin

- How Neuromodulator Injections Can Help You Achieve a Non-Surgical Facelift